Shropshire Councillors will next week vote on whether to ask the county’s flagship pension fund to stop investing in fossil fuels.

Pressure is mounting on the Shropshire County Pension Fund to move to greener investments for environmental as well as financial reasons, in light of a reduce in demand across the sector during the coronavirus pandemic.

The fund manages the retirement funds of employees of Shropshire and Telford & Wrekin councils, Shropshire Fire and Rescue Service and the county’s town and parish councils.

A motion tabled by Shropshire Council’s only Green Party councillor calling on the authority to push the pension fund towards divestment will be debated by the full council at a meeting on Thursday.

Councillor Julian Dean’s motion reads: “Shropshire and Telford & Wrekin Councils have both declared climate emergencies and pledged to be net zero by 2030.

“Shropshire County Pension Fund currently has around £294 million invested in fossil fuel companies including Shell and BP and through asset manager BlackRock.

“These investments are incompatible with the climate emergency declaration and the councils’ commitment to reach net zero within the next ten years.

“Fossil fuel investments are increasingly financially risky as a result of both the Covid-19 pandemic and the global transition to a more sustainable economic and environmental model. They are now being regularly out-performed by renewables.”

The motion has been supported by Liberal Democrat councillors Hannah Fraser and David Vasmer, and independent member Pauline Dee.

If it is passed, the council’s acting chief executives will write to the pension fund committee asking for all funds currently invested in fossil fuels be re-invested within three years.

The ‘engagement’ approach does not mitigate the financial risks the sector faces. There is also no evidence of any multinational corporation changing its core business model in response to investor pressure.

Council believes it is time for Shropshire’s flagship pension fund to commit to divestment from fossil fuels over a three year time frame.

Councillor Dean says: “This would allow for the development of ‘impact investment’ directed towards internationally recognised sustainable development goals and/or investment in a local sustainable economy, provide for a more sustainable future of all pension fund stakeholders, and provide leadership in the face of the climate emergency. “

Hundreds turned away without voter ID at PCC poll in Shropshire

Hundreds turned away without voter ID at PCC poll in Shropshire

Disused chapel to be turned into holiday home

Disused chapel to be turned into holiday home

Man killed in A44 crash named

Man killed in A44 crash named

Herefordshire Council to get cash to buy flats for homeless

Herefordshire Council to get cash to buy flats for homeless

Man killed in North Herefordshire collison

Man killed in North Herefordshire collison

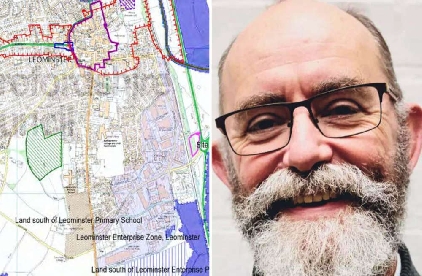

Is Leominster about to miss new housing boat?

Is Leominster about to miss new housing boat?

Assurances given over council overspend

Assurances given over council overspend

Spending on lethal tree disease announced

Spending on lethal tree disease announced